2 Private insurance

“US Healthcare system Chapter 6” by Deanna L. Howe, Andrea L. Dozier, Sheree O. Dickenson, University of North Georgia Press is licensed under CC BY-SA 4.0

2.1 LEARNING OBJECTIVES

By the end of this chapter, the student will be able to:

- Define managed care

- List the pros and cons of managed care

- Distinguish the primary types of health maintenance organizations

- Discuss how managed care impacts healthcare

- Explain private insurance

- Explain problems associated with Fee-for-Service healthcare plans

- State questions to consider before deciding on a healthcare plan

- Discuss the benefits of worker’s compensation insurance for employees

2.2 KEY TERMS

- Health Maintenance Organization (HMO)

- Exclusive Provider Organization (EPO)

- managed care

- medical underwriting

- Point of Service plan (POS)

- Preferred Provider Organization (PPO)

- provider networks

- worker’s compensation insurance

- Private Insurance

2.3 INTRODUCTION

Healthcare coverage for average Americans has been much discussed over the years. Private insurance and managed care organizations are often confusing to consumers. This chapter will provide a brief summation of private insurance and four major types of managed care organizations. These four major types of managed care organizations are as follows: Preferred Provider Organizations (PPOs), Point of Service plans (POS), Health Maintenance Organizations (HMOs), and Exclusive Provider Organizations. The chapter will include discussion on the advantages and disadvantages of managed care options. Finally, there is discussion of worker’s compensation insurance.

2.4 FEE-FOR-SERVICE

Fee-for-Services plans were the staple of healthcare service plans in the U.S. before the advent of private insurance and managed care organizations. Fee-for-service is a method for which healthcare providers are paid for each individual service rendered. Payment can be from an individual or through a health insurance plan. Treatments or procedures that were deemed necessary by the healthcare provider were often conducted without approval from insurance agencies (U.S. Legal, 2019). This caused discord between healthcare providers and insurance companies who frequently disagreed on prescribed healthcare treatments. This conflict often resulted in delayed consumer medical care. Private healthcare insurance and managed care organizations would eventually change the way healthcare services were offered and payments for services were received.

2.5 PRIVATE INSURANCE

Healthcare coverage not sponsored by the government is known as private insurance. Many individuals have private insurance through their employers. In fact, approximately 60% of non-elderly Americans do so (Anderson, 2018). An employer sponsored private insurance policy charges employees a fee for their insurance coverage. However, many companies cost share and pay a significant amount of employee premiums. This fee is usually deducted from the employee’s paycheck. There is often an open enrollment time frame whereby employees can choose the desired health insurance coverage options. New employees are offered the opportunity to gain healthcare coverage upon their hiring date as well. The option of private insurance is very important to a lot of employees and their families, so many people investigate private insurance benefits when job seeking.

While the employer-sponsored private health insurance is quite popular, some individuals can purchase private insurance without an employer. For instance, self-employed individuals may purchase private healthcare plans from insurance companies. Before the Affordable Care Act (ACA), the acquisition of individual private insurance was a bit more complicated. For one thing, individual market insurance companies could decide the costs of premiums and whether to accept or deny individual healthcare coverage based on pre-existing conditions. This process is known as medical underwriting and is no longer used because of the Affordable Care Act (Healthinsurance.org, 2020). The ACA now prohibits discrimination against an individual based on pre-existing conditions, and the cost of the coverage is no longer a factor in determining the premium (Norris, 2019).

The cost of healthcare coverage depends on several factors. For example, the cost of private insurance may be influenced by the number of individuals the plan covers. The price may differ between the employee only having coverage for themselves versus the employee having healthcare coverage for their immediate family members. Additionally, components of private insurance healthcare plans may include options for medical, vision, dental, and short-term, long-term, and disability care coverage. Further, an overwhelming majority of U.S. residents have health insurance plans that are a part of a managed care program (Speights, 2018).

2.6 MANAGED CARE BACKGROUND

According to the U.S. National Library of Medicine (2019), managed care insurance plans consist of contractual agreements between medical facilities and healthcare providers to render healthcare at lower consumer costs. The providers are known as the managed care network. Managed care systems help provide organization, quality, and cost containment to healthcare services for clients.

Managed care has historical beginnings from the late 1920s (National Council on Disability, n.d.). Dr. Michael Shadid launched a small Oklahoma hospital to provide needed medical care for farmers who had limited access to such care. An annual fee schedule covered the care this hospital provided. This type of medical service with yearly fees or prepaid contracts by physicians began to expand both in Oklahoma and such other places as California. Through the years, the term managed care became associated with this type of contractual healthcare coverage. Managed-care plans helped curtail increasing healthcare costs by discouraging participating physicians from needless patient hospitalizations. Physicians were also required to provide healthcare at lower costs.

With managed care, healthcare providers receive predetermined fee-for-service rendered to clients. Unnecessary medical treatments are often avoided because of the insurance company’s refusal to pay without preauthorization. This helps decrease consumer healthcare costs.

2.7 MANAGED CARE ORGANIZATIONS

Given that employers pay a considerable portion of U.S. healthcare insurance costs, the introduction of managed care organizations provides a more systematic guideline for healthcare providers to follow, which helps cut those costs (U.S. Legal, 2019). Physicians and statisticians usually work together to devise generalized guidelines for clients based on their symptoms or conditions. When this is done, the managed care organizations can prescribe what treatments and procedures are most beneficial to applicable clients based on client diagnoses and symptoms. Managed care organizations also predetermine the cost of these treatments and procedures, including hospital stays (if needed).

Provider networks are a pivotal component of managed care systems. Members of provider networks may include hospitals, advanced healthcare practitioners, and doctors who work together to provide the most efficient, cost-effective care for consumers. There are two types of provider networks: in-network providers and out-of-network providers. As the names indicate, in-network providers work with insurance plans to provide services, while out-of-network providers opt not to participate in contractual agreements. Providers choosing to become part of a managed care system agree to work with networks in attempts to contain costs of healthcare services. Additionally, providers that opt to become part of a managed care system are expected to comply with specified quality standards and predetermined healthcare costs to decrease the amount clients are expected to pay (U.S. National Library of Medicine, 2018).

2.8 TYPES OF MANAGED CARE ORGANIZATIONS

Preferred Provider Organizations (PPO)

Preferred provider organizations (PPOs) are a prevalent type of managed care organization. PPOs have a Preferred Provider Arrangement which serves as a contractual agreement with a group of large healthcare providers to keep the cost down for clients. Costs associated with client care are predetermined, which prohibits physicians from charging higher client fees (Medical Mutual, 2020). Enrollees within PPOs have a choice to use providers and hospitals within the network or not. Incentives, such as decreased deductibles and lower copayments, are used to encourage consumers to use in-network doctors. If the enrollee chooses to use a provider that is not part of the network, the cost of the rendered healthcare service is higher. In other words, enrollees can opt to save their cost by choosing a provider within the network. Nevertheless, no referral is needed if the client selects a provider outside of the network. The premium of a PPO is often higher than an HMO, which means the costs to the client is higher. However, it should be noted that PPOs are more flexible than HMOs.

Pros |

Cons |

| Larger network | Higher premiums |

| Can go out of network | Deductible |

| No referral needed |

Point of Service Plan (POS)

Point of Service (POS) plans are like PPOs except when the client chooses a provider outside of the network and has a referral from their primary healthcare provider, the cost of services is covered by the medical insurance (Small Business Majority, 2019). However, if the client chooses to see an out-of-network provider without a physician referral, the client is responsible for a portion of the bill. The client will also have to meet their deductible and copayment. A deductible is a cost the consumer is required to prepay to receive the benefits indicated in the health insurance policy (WiseGeek, 2020). Consumers may have high or low deductible plans depending on their preferences. A high deductible requires the consumer to pay more out of pocket expenses, while a low deductible requires consumers to pay less. Once the deductible is met, the insurance company will cover the cost of the services. The healthcare premium cost is often influenced by the type of deductible an individual selects.

Pros |

Cons |

| Can go out of network | Need to file claims for out-of-network care |

| No referral needed | Higher deductible than PPO and HMO |

Health Maintenance Organizations (HMO)

In contrast to PPOs, HMO enrollees do not have the same level of flexibility when choosing a provider. Yet, HMOs are associated with lower premiums. Additionally, while a primary care physician is not required in a PPO, a primary care provider must be selected in an HMO. Named by Dr. Paul Elwood, the purpose of HMOs was to offer prepaid group practices, which meant lower cost

and improved utilization of healthcare services for consumers (Yesalis et al., 2013). Not surprisingly, the advent of HMOs was met with resistance from physicians who preferred more flexibility when providing care under the fee-for-service plan.

HMOs generally cover treatment costs if care is rendered within the network. However, it should be noted that treatments for emergency care, out-of-area urgent care, or out-of-area dialysis care services are excluded from provider networks, which means patients can receive these services from providers outside of the network without penalty (U.S. Centers for Medicare & Medicaid Services, n.d.). With this type of plan, it is recommended that approval for services is obtained before services are rendered to decrease the client’s cost (U.S. Centers for Medicare & Medicaid Services, n.d.). Except for yearly screening, referrals are needed for specialist visits. HMOs usually do not provide coverage for services rendered outside of the network unless it is a service that the listed providers are not conducting. Individuals receiving care from providers outside of the network may ultimately be responsible for the cost of care received unless in the case of an emergency.

Pros |

Cons |

| Lower premiums | Need to stay in network |

| Lower costs than PPO | Referral needed to see a specialist |

Exclusive Provider Organizations (EPO)

Consumers opting for an exclusive provider organization (EPO) managed care plan receive insurance coverage when they receive care from in-network providers (Silva, 2019). However, if an out-of-network provider is chosen, the services are not covered by the health insurance plan, unless in an emergency. Consumers with the EPO plan have a primary care physician who provides comprehensive care. It should be noted that unlike other types of insurance plans, EPO clients have a limited network from which to choose. An advantage of EPOs is that referrals are not needed for a specialist visit.

Pros |

Cons |

| Referral not needed | Need to stay in network |

| Limited network |

2.9 WHICH TYPE OF HEALTHCARE PLAN IS RIGHT FOR YOU?

Many managed care plans are available and which plan fits you and your family’s needs is a personal choice. Individuals should be knowledgeable about the options of each plan based on several factors. Some general questions to think about when deciding include the following:

- Do you have a preferred primary care provider? If so, are they participating in a managed care organization?

- How much are you willing to contribute to healthcare premiums monthly?

- How much flexibility do you desire regarding healthcare provider choices?

- Do you often visit a specialist? If so, are they members of a managed care group?

- Are you willing to pay a copayment or coinsurance if required?

Pause and Reflect

Has your workplace ever given you a booklet of the health plans available to choose from? There may be several noted, with all the prices for copays, deductibles, yearly maximums, and services provided. How do you choose?

What are some advantages and disadvantages of a managed care system?

2.10 WORKERS’ COMPENSATION INSURANCE

Workers’ compensation insurance provides benefits to employees if they are hurt on the job or as a result of some work-related activity. The genesis of workers’ compensation benefits goes back to 2050 B.C. in Ancient Sumeria, Greece, and China when workers were paid for injuries suffered on the job (Hartford, 2020). In 1887, Prussian Chancellor Otto von Bismarck, created laws called “sickness and accident laws” which provided limited protection to those working in factories, quarries, railroads and mines. Not until 1911 did individual states within the U.S.

begin to pass workers’ compensation law; it took another thirty-seven years before every state had compensation laws (Hartford, 2020). The U.S. Department of Labor (n.d.) created the Occupational Safety and Health Act (OSHA) of 1970 “to ensure safe and healthful working conditions for working men and women by setting and enforcing standards and by providing training, outreach, education and assistance” (para. 1). OSHA mostly covers private sector employers and workers. The U.S. Department of Labor, Office of Workers’ Compensation Programs oversees federal workers and claims for work related injuries.

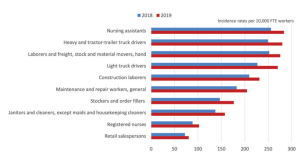

Some work settings and occupations are more dangerous than others. In the U.S., logging workers, fishers, aircraft pilots, and roofers have the highest rates of fatal injuries (Kiersz & Hoff, 2020). However, non-fatal injuries account for a majority of cases. In 2019, there were 888,220 injuries or illness resulting in days off of work (Bureau of Labor Statistics (BLS), 2020). In 2019, ten occupations accounted for 33.2% of days away from work as a result of injury or exposure (BLS, 2020) (Figure 2.1). Examples of injury or exposure are employees working in manufacturing harmed as a result of machinery, toxins, or cramped settings; employees working in mining harmed from breathing in dirty air or a sudden collapse of a mine; and healthcare workers in the hospital setting being hurt physically by moving patients or by contracting diseases, such as hepatitis, HIV, or COVID-19. Injuries do not have to be permanent or life-threatening. For example, the most common causes of non-fatal workplace injuries in 2019 were overexertion, falls, slips, trips, contact with objects of equipment, violence or injuries caused by people or animals, and transportation accidents (BLS, 2020). Compensation insurance ensures funds are available to pay for medical care; rehabilitation services; lost wages; and, potentially, funeral expenses.

Source: US Bureau of Labor Statistics

Attribution: US Bureau of Labor Statistics

License: Public Domain

In addition to state laws, many large companies whose employees are at a higher chance of injury have implemented health and safety teams who are able to respond at the time of injury. These teams also study and create policies and work procedures which protect employees on the job. These same organizations may provide employee health clinics and first responders in the case of injury. The ultimate goals are to have healthy, injury free employees and maintain productivity.

First Person Perspective

Nurse M, RN-eNLC, CCM, has thirteen years of experience as a nurse, seven years certified in case management, and works as a Workers Compensation Nurse Case Manager for her company.

Figure 2.2: First Person Perspective

Source: Original Work

Attribution: Deanna Howe

License: CC BY-SA 4.0

As a worker’s compensation Nurse Case Manager, I act as a liaison between the employee, their medical team, employers, insurance carriers, and other stakeholders involved in the management of a worker’s comp claim. Work injuries can range from minor to catastrophic and often are very stressful events for the injured worker and their families. Nurse Case Managers educate and advocate for the injured worker and guide them through the entire process so they know what to expect. My involvement in a worker’s compensation claim tends to benefit injured workers by streamlining the process for faster, more complete access to care, improved care quality, and better recovery outcomes. Employers, insurance carriers, and other stakeholders benefit from improved communication flow, faster returns to work, quicker claims closure, and lower overall workers’ compensation costs.

Providing worker’s comp case management during the worldwide COVID-19 pandemic has brought new challenges as many physicians have moved to telemedicine formats. Case managers are now coordinating and educating injured workers on how to connect with their physicians virtually rather than in person. I am also beginning to receive cases involving injured workers who most likely contracted COVID-19 while at work, including those involved in healthcare and factory workers. While many who contract COVID-19 have mild cases with no known lasting effects following their recovery, others are not so lucky.

Although I no longer provide bedside nursing, it is my nursing foundation learned during nursing school that instilled in me that it is the nurse who upholds patient’s rights and serves as liaison with their physicians, families, and other involved parties—because we are advocates. Worker’s comp case management can be very challenging and not all nurses can be successful case managers. Collaboration, well- supported clinical judgement, and negotiation are key skills for a case manager to possess. I do not see myself leaving the field of worker’s comp case management; I enjoy the challenges. Knowing my presence on the case was instrumental in the injured worker having a favorable outcome and returning to his pre-injury condition is very rewarding. First person perspective vignette collected and created by D. Howe, 2020. For your consideration: Nurse M. describes her role as a nurse advocating for the worker.

First person perspective vignette collected and created by D. Howe, 2020.

For your consideration:

Nurse M. describes her role as a nurse advocating for the worker.

- Have you ever known someone who was injured on the job?

- Did they have worker’s compensation insurance available?

- If not, how does worker’s compensation insurance protect the worker?

- How does this insurance protect the employer?

- If you were injured on the job, how could a nurse case manager help you through the process of seeking treatment and recovery?

- What laws should be in place to protect workers who do not have access to worker’s compensation insurance?

SUMMARY

Private insurance and managed care organizations provide consumers the opportunity to receive healthcare services at a reduced cost. Many individuals have healthcare insurance from their employers. Self-employed individuals can obtain healthcare coverage from the individual’s health insurance marketplace without discrimination against preexisting conditions. A significant goal of managed care is to provide consumers with quality healthcare. With managed care, guidelines are provided to help ensure predetermined protocols are followed, which may include specific diagnostics, medications, and treatment regimens based on the diagnosis of the consumer. The four major types of managed care plans are Health Maintenance Organization, Preferred Provider Organization, Exclusive Provider Organizations, and Point of Service plans. Individuals have the option to utilize in-network providers at a reduced cost or may use out of network providers at a higher price in specific managed care plans. Some managed care plans are more flexible and do not require referrals for specialist visits, while others are less flexible and may not pay any amount if a consumer does not get a referral before receiving services from a specialist and out of network provider. Workers’ compensation insurance is a benefit to pay for medical treatment and loss of wages as a result of injury on the job.

REVIEW QUESTIONS

1. What are the major types of managed care organizations?

2. What were some problems associated with Fee-for-Services plans in the U.S.?

3. What are the differences between POS, HMO, PPO, and EPO managed care organizations?

4. How does managed care impact healthcare?

5. What are three general questions to ask before deciding on a healthcare plan?

6. Describe how worker’s compensation insurance benefits employees who are injured on the job.